The SharkShop Advantage: How It Can Help Improve Your Credit Rating

The SharkShop Advantage: How It Can Help Improve Your Credit Rating

**Unlocking Your Financial Future: The SharkShop Advantage**In a world where credit scores can make or break your financial opportunities, navigating the murky waters of credit ratings can often feel overwhelming.

Enter Sharkshop.biz a game-changing platform designed to help you not just understand but also improve your credit score along the way! Whether you’re dreaming of that new home, looking to secure a better interest rate, or simply aiming for financial freedom, SharkShop offers tailored solutions and expert insights to elevate your credit profile.

Dive in with us as we explore how this innovative tool can transform your approach to credit management and set you on the path toward a brighter financial future!

Introduction to the SharkShop Advantage and its purpose in improving credit ratings

Are you tired of being held back by a low credit score? Do missed payments and high debt seem to haunt your financial dreams? Enter SharkShop, the innovative solution designed to help you transform your credit rating.

With a unique approach tailored for each individual, SharkShop is on a mission to empower consumers like you. Whether you’re looking to secure that dream home or snag the best loan rates, improving your credit rating can open doors previously thought locked.

Let’s dive into how Sharkshop.biz can be your ultimate ally in navigating the often murky waters of credit management. Your journey toward better financial health starts here!

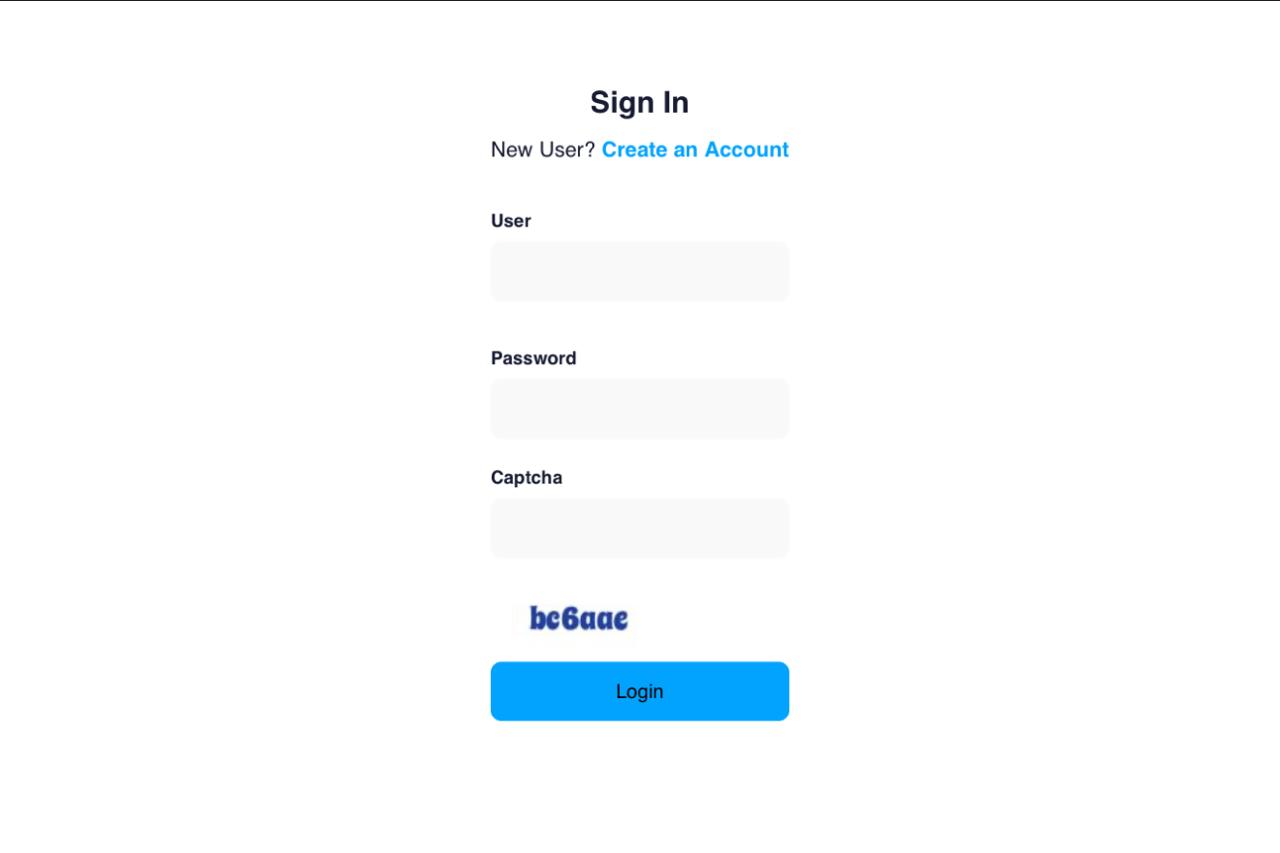

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Credit Ratings: What They Are and Why They Matter

Credit ratings are numerical scores that reflect an individual’s creditworthiness. They range typically from 300 to 850, with higher scores indicating better financial reliability.

Lenders use these ratings as a tool to assess the risk of lending money or extending credit. A strong credit rating can open doors to favorable loan terms, lower interest rates, and even employment opportunities in certain industries.

Understanding your credit rating SharkShop is vital for making informed decisions about borrowing and spending. It influences everything from mortgage approvals to insurance premiums.

Maintaining a good score requires awareness of your financial habits and timely payments. The impact of your rating ripples through various aspects of life, affecting both short-term and long-term financial health.

The Impact of Credit Ratings on Financial Opportunities

Credit ratings play a crucial role in shaping your financial landscape. A higher score opens doors to better loan terms, lower interest rates, and increased chances of credit approval.

Lenders view credit ratings as a reflection of risk. The healthier your score, the more confidence they have in you as a borrower. This can lead to significant savings over time.

Conversely, poor credit scores limit options. They may result in denials for loans or exorbitant interest rates that strain budgets.

Even renting an apartment can hinge on your credit rating. Landlords often check scores before making rental decisions.

In today’s competitive environment, maintaining a good credit score is essential for seizing opportunities and achieving financial goals. Making informed choices today will pave the way for brighter prospects tomorrow.

Related: Feshop

How the SharkShop Advantage Works to Improve Your Credit Rating

The SharkShop Advantage employs a personalized approach to credit improvement. Each client receives a tailored plan designed to address their unique financial situation. This custom strategy ensures that individuals focus on the most impactful areas for improving their credit scores.

Monitoring plays a crucial role in this process. SharkShop offers efficient tools that track your credit activity, alerting you to any changes or potential issues. Staying informed empowers clients to take proactive steps toward maintaining and enhancing their rating.

Additionally, experts at SharkShop provide ongoing support and guidance throughout the journey. Their knowledgeable team helps users navigate complex credit landscapes, making it easier for them to understand what actions can yield the best results.

Success stories abound from satisfied clients who have experienced notable improvements in their ratings after utilizing SharkShop’s services. These transformations showcase the effectiveness of dedicated credit management strategies tailored specifically for individual needs.

– Benefits of using SharkShop’s services

The SharkShop login Advantage offers a range of benefits that can significantly enhance your credit rating. One key advantage is their customized approach. Instead of one-size-fits-all solutions, they tailor services to fit your unique financial situation.

Access to expert guidance also makes a difference. Their team consists of seasoned professionals who understand the intricacies of credit scores and reporting. This expertise helps clients navigate challenges effectively.

Another benefit is the seamless integration with advanced technology for monitoring credit activity. SharkShop provides real-time updates, ensuring you stay informed about changes to your score or any potential issues.

Additionally, users often report feeling more empowered in managing their finances thanks to personalized insights from SharkShop’s services. This empowerment fosters better habits and encourages proactive steps toward achieving financial goals.

– Personalized credit improvement plans

Personalized credit improvement plans are at the heart of what SharkShop offers. Each individual’s financial situation is unique, making a one-size-fits-all approach ineffective.

When you join SharkShop, you receive tailored strategies designed to meet your specific needs. This means assessing your current credit score and identifying areas for growth.

Expert consultants work with you to create actionable steps that align with your financial goals. Whether it’s reducing debt or improving payment history, each plan is crafted just for you.

Clients appreciate the hands-on guidance throughout their journey. Personalized support ensures you’re never alone in navigating challenges and celebrating milestones along the way.

With these customized plans, clients can feel more empowered about their finances—leading to lasting improvements and brighter financial futures.

– Efficient credit monitoring and management

Efficient credit monitoring is crucial in today’s fast-paced financial world. With SharkShop, clients benefit from real-time updates on their credit activity. This proactive approach allows individuals to catch any discrepancies or unexpected changes before they escalate.

Management tools provided by SharkShop help users understand their credit standing at a glance. Intuitive dashboards display current scores and highlight areas for improvement.

Regular alerts notify clients of important changes, ensuring they stay informed about their financial health. Whether it’s a new account opening or shifts in debt levels, being aware empowers better decisions.

Furthermore, comprehensive reporting helps users track progress over time. By visualizing improvements and setbacks alike, consumers can adapt strategies effectively and foster healthier credit habits that last long-term.

– Success stories from satisfied clients

At SharkShop, success stories abound. Clients often share how their credit ratings transformed dramatically within just a few months.

One client, Sarah, saw her score jump from the low 600s to an impressive 750. With personalized guidance and actionable steps from SharkShop, she tackled old debts that had been dragging her down for years.

Another satisfied customer, James, was initially skeptical about improving his credit rating. However, after utilizing the services provided by SharkShop, he secured a mortgage with favorable terms—an achievement he once thought impossible.

These real-life examples illustrate how tailored strategies can turn financial dreams into reality. Each story is unique but reflects a common theme: empowerment through informed decisions and expert support offered by SharkShop.

Tips for Maximizing the Benefits of the SharkShop Advantage

To truly harness the power of SharkShop, consistent monitoring of your credit score is crucial. Regular check-ins allow you to track improvements and identify areas that need attention.

Responsible credit card usage plays a significant role in building a healthy credit profile. Keep balances low and avoid maxing out your cards. This demonstrates reliability to potential lenders.

Timely payments cannot be overstated. Set reminders or automate payments to ensure bills are paid on time. Late payments can severely impact your score, so staying punctual is key.

Debt management also matters greatly for improvement strategies. Prioritize high-interest debts first while maintaining minimums on others. This approach will help reduce financial strain over time.

Engaging with SharkShop cc personalized resources enhances understanding as well, providing tailored advice that aligns with individual goals and situations.

– Responsible credit card usage

Responsible credit card usage is key to maintaining a healthy credit rating. It’s easy to get swept up in the excitement of having access to funds, but caution is crucial.

Start by establishing a budget. Know exactly how much you can afford to spend each month without straining your finances. Stick to this plan religiously.

Always aim for paying off your balance in full each month. This practice not only prevents interest from accumulating but also shows creditors that you’re reliable.

Limit the number of cards you use regularly. Having multiple accounts can complicate tracking spending and managing payments, which may lead to missed deadlines or overspending.

Lastly, monitor your credit utilization ratio carefully. Keeping it below 30% helps signal that you’re responsible with borrowed money, further boosting your overall credit score over time.

– Consistent monitoring of credit score

Consistent monitoring of credit score is an essential aspect of maintaining a good credit rating. At SharkShop, we understand the importance of keeping track of your credit score and offer tools to help you do just that. In this section, we will discuss why consistent monitoring is crucial and how SharkShop can assist in improving your credit rating through this practice.

Firstly, let’s define what a credit score is and why it matters. A credit score is a numerical representation of an individual’s creditworthiness, which reflects their borrowing history and repayment habits. It ranges from 300 to 850, with a higher score indicating better financial health.

Your credit score impacts various aspects of your financial life, such as loan approvals, interest rates, insurance premiums, and even job opportunities. Therefore, it is vital to keep track of your credit score regularly.

Moreover, tracking your credit score also allows you to monitor any changes that might occur due to new accounts opened or closed or changes in payment history. This enables you to take action promptly if there are any sudden drops in your score.

At SharkShop, we offer personalized alerts for significant changes in your report so that you can stay on top of things at all times. Our Credit Monitoring feature also includes access to monthly updates of all three major bureaus’ reports so that you have a comprehensive understanding of where you stand financially.

– Timely payments and debt management

Timely payments are the backbone of maintaining a healthy credit rating. Each month, as bills arrive, treating them with urgency can make all the difference. Setting up reminders or automatic payments helps ensure you never miss a due date.

Debt management is equally crucial. It’s not just about paying bills on time; it’s about having a strategy in place. Prioritizing high-interest debts first can save money over time and improve your score faster.

Consider creating a budget that allocates funds specifically for debt repayment. This way, you’ll know exactly how much to pay each month while also setting aside money for essential expenses.

Being proactive with both timely payments and effective debt management creates confidence in your financial health. With these practices, improving your credit rating becomes more achievable than ever before.

Frequently Asked Questions About the SharkShop Advantage

Curious about the SharkShop Advantage? You’re not alone. Many people wonder how it can specifically help with credit improvement.

One common question is whether SharkShop guarantees a specific increase in your credit score. While results vary, their strategies are designed to enhance your overall financial health.

Another frequently asked query revolves around costs. SharkShop offers various plans tailored to fit different budgets and needs, making financial wellness accessible for everyone.

Many also ask about the time frame for seeing improvements. Typically, clients notice changes within a few months, thanks to proactive monitoring and personalized plans.

Lastly, potential users often inquire if they need prior knowledge of credit management to benefit from SharkShop’s services. The answer is no; their team provides all the guidance you need right from day one.

Real Life Success Stories: Testimonials from Clients Who Improved Their Credit Rating with SharkShop

The power of the SharkShop Advantage is best illustrated through the experiences of its clients. Many have transformed their financial lives thanks to personalized support and expert guidance.

Take Sarah, for example. After struggling with low credit scores due to missed payments, she turned to Sharkshop.biz for help. The team crafted a tailored plan focusing on her unique situation. With consistent monitoring and advice on responsible usage of credit cards, Sarah saw significant improvements in just months. Her score climbed from 580 to an impressive 700.

Then there’s Mark, who faced challenges after a difficult divorce that affected his finances. He felt overwhelmed by debt but found hope when he joined SharkShop’s program. Through dedicated debt management strategies and timely payment reminders, Mark regained control over his finances and improved his credit rating significantly.

These success stories showcase how individuals can turn their financial situations around with the right tools at hand. Whether it’s increasing your chances for loan approvals or securing better interest rates, the impact is undeniable.

SharkShop isn’t just about numbers; it’s about real people achieving their dreams again—one credit score at a time.