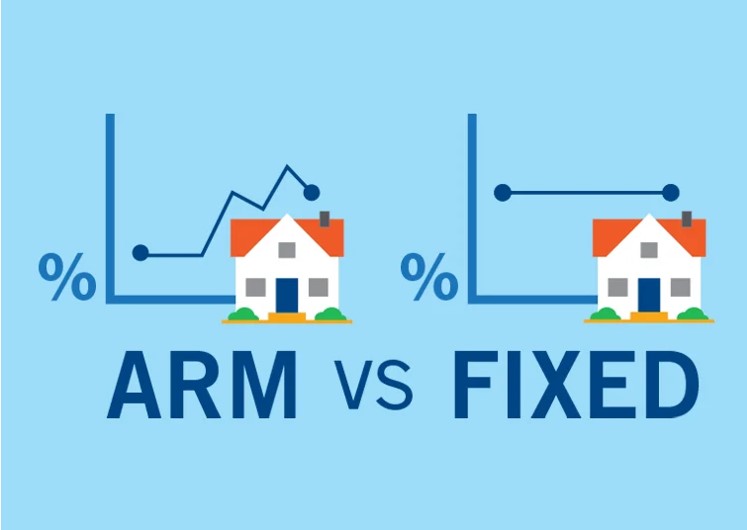

Fixed vs. Adjustable Mortgage Rate: Key Benefits Explained

When considering a mortgage loan, deciding between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is one of the most critical decisions a potential homeowner can make. This choice can significantly influence the total cost of housing over the life of the loan and the monthly payment stability.

Understanding the benefits of both fixed and adjustable mortgage loan interest rates can help you make a more informed decision tailored to your financial situation and long-term goals.

Fixed-Rate Mortgage Loans

A fixed rate mortgage loan features an interest rate that remains constant for the entire term of the loan, typically 15, 20, or 30 years. This kind of mortgage loan is incredibly popular in the United States, and for good reasons.

1. Stability and Predictability

One of the most significant advantages of a fixed-rate mortgage loan is stability. Since the mortgage loan interest rates do not fluctuate, your monthly payments remain the same throughout the life of the loan. This predictability makes budgeting easier and provides a sense of financial security, knowing that your most significant monthly expense will not change.

2. Protection Against Market Fluctuations

With a fixed-rate mortgage, homeowners are protected against interest rate hikes in the market. Regardless of economic conditions, inflation, or changes in the Federal Reserve rates, your mortgage loan interest rates remain unaffected.

This is particularly beneficial during periods of rising interest rates, ensuring that you continue to pay the same lower rate that was initially agreed upon.

3. Long-Term Planning

Fixed-rate mortgage loans are ideal for individuals planning to stay in their homes long-term. The consistency in payments allows homeowners to plan their finances over many years without worrying about fluctuating mortgage costs. This kind of mortgage loan suits families or individuals looking to plant long roots in their community.

Adjustable-Rate Mortgage Loans

An adjustable-rate mortgage loan has interest rates that change periodically based on market conditions. These loans often start with a lower interest rate than fixed-rate mortgages, which can change at predetermined intervals. Commonly, ARMs are expressed as 3/1, 5/1, or 7/1, where the first number represents the fixed-rate period in years, and the second number indicates how often the rate adjusts after the initial period.

1. Lower Initial Rates

One of the primary benefits of an adjustable-rate mortgage loan is the lower initial interest rate compared to fixed-rate mortgages. This translates to lower initial monthly payments, making homeownership more affordable, particularly for first-time homebuyers or those with lower initial budgets.

2. Potential for Savings

Since ARMs start with lower mortgage loan interest rates, homeowners can save money in the initial years of the loan term. If interest rates remain stable or decrease, borrowers can benefit from lower monthly payments over an extended period.

Additionally, if you plan to move or refinance before the adjustment period kicks in, you can take advantage of the initial lower rate without experiencing the potential risks of future interest rate increases.

3. Flexibility

ARMs offer flexibility that can be particularly beneficial for certain homeowners. If you anticipate a significant increase in your income in the near future, expect to move within a few years, or plan to sell your home before the rate adjusts, an adjustable-rate mortgage loan can provide short-term affordability without long-term commitment to a potentially higher rate.

Choosing the Right Option

When deciding between fixed and adjustable mortgage loan interest rates, it’s essential to evaluate your financial goals, risk tolerance, and how long you plan to stay in your home.

Fixed-Rate Mortgage Loans are more suitable for risk-averse individuals who prioritize long-term stability. If you prefer consistent payments and want to avoid the uncertainty of fluctuating interest rates, a fixed-rate mortgage is the right choice for you.

This option is also recommended for those planning to stay in their homes for a long time, as the predictability can aid in solid financial planning.

Adjustable-Rate Mortgage Loans, on the other hand, can be advantageous for homebuyers who seek lower initial payments and are comfortable with some level of risk. If you plan to relocate within a few years or anticipate an increase in your income, an ARM can offer significant savings in the short term.

However, it’s crucial to have a clear exit strategy before the adjustable period begins, as rising mortgage loan interest rates can lead to higher monthly payments in the future.

Conclusion

The decision between fixed and adjustable mortgage loan interest rates is a significant financial choice that requires careful consideration of your circumstances and future plans. Both fixed-rate and adjustable-rate mortgage loans offer distinct benefits that can align with different financial situations and homeowner priorities.

Fixed-rate mortgage loans provide the stability and predictability of consistent payments over the loan term, making them ideal for long-term homeowners and those who are risk-averse. Conversely, adjustable-rate mortgage loans offer lower initial rates and the potential for short-term savings, suitable for buyers who plan to move or refinance within a few years and are comfortable with some degree of market risk.

In the end, choosing the right mortgage loan depends on your individual financial goals, market conditions, and how long you plan to stay in your home. By carefully weighing the benefits of both fixed and adjustable mortgage loan interest rates, you can select the mortgage type that best suits your needs and ensures your financial stability in the years to come.